The staggering value of "other stuff" sold by Apple

/Apple have just announced that their annual developers' conference WWDC will remain online in 2022. You can look forward to 4 days of nerdy tech stuff about coding iOS, MacOS, iPadOS, etc. Which got me thinking about my first Mac, bought in 2002; an angle poise iMacG4, with swivel neck and 256MB of memory. Apple Inc has done well since then. What I should have done in 2002 was not buy a shiny machine that was redundant just two years later, but purchase some Apple stock.

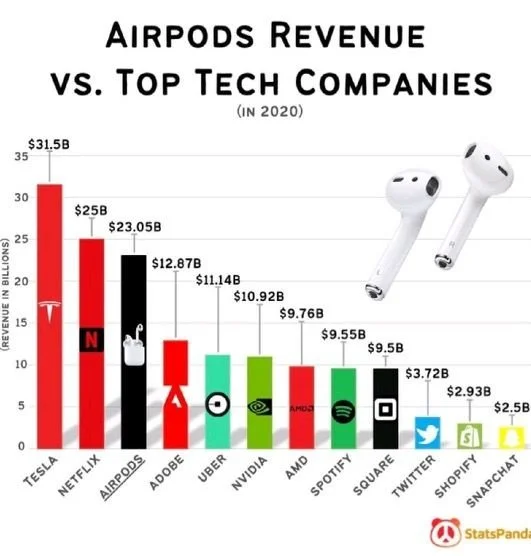

In 2002, an Apple share was $23. By 2019 the share price was $230, but interestingly, that story of enormous value growth was not about the Mac, or even the ubiquitous iPhone, it was also about a clever cultivation of the “Apple eco-system", or rather "other stuff" to you and me. To illustrate, the market cap of Apple in 2002 was about $23 billion - which is about the same as the 2020 revenues for AirPods alone. Staggeringly, the replacement business for "earbuds and cases" is estimated to be worth over $7 billion in revenues.

My point? Well, who knew? Growth doesn't have to be about just swimming more effectively in the same lane; it's about developing adjacent and "non-linear" business, which can sometimes outstrip the core product offer. So beware of keeping ploughing down the same lane and make your "other stuff" as attractive as the core offer.

[Ed. Article originally published on Linked-in.]